Popular Posts

-

I have used every one of these resources as a graphic designer and website developer and have hand picked all of these resources based on th...

-

BADGES Web 2.0 Badges - A set of free badges to download and use in your own designs. Fresh Badge - Quickly generate your own badge. adClu...

-

The Indian finance ministry has begun a public competition to select a design for the symbol of ...

-

Navigation menus have really important role in any website. For big sites full with a lot of pages and articles, drop down menus and tabs ar...

-

For web designers and graphic designers, gradients provide almost unlimited options for creating the perfect look. This list is a collection...

-

Professional networking is an important part of being a designer and working towards a challenging and rewarding career. Unfortunately, most...

-

Within the music industry there is a great variety in terms of the quality of websites. Some bands have excellent, creative websites, and ot...

-

During current economical times, it’s becoming increasingly difficult to find and secure good clients. A “good” client is one who plays on t...

-

We live in a world surrounded by Times New Roman, Arial and Helvetica, typefaces so functional that they have long since become boring. It’s...

-

MailShadowG is an application that will allow you to sync Outlook with Gmail. MailShadowG is a product of Cemaphore Systems , a California b...

Market information

Blog Archive

Website Designing

- Website Designing (133)

- design (100)

- Design Reviews (63)

- web 2.0 (63)

- Cool Websites (61)

- Photoshop (59)

- Tech News (53)

- Social Media Network (50)

- Search Engine Optimization (44)

- Usability (42)

- tutorials (38)

- Graphic (37)

- Insights (33)

- css (28)

- inspiration (26)

- Internet Marketing (25)

- Freelancing (23)

- google (23)

- Current Economic Scenario (17)

- Branding (15)

- accessibility (13)

- showcase (13)

- Image Optimization (12)

- Internet (12)

- Offshore (12)

- Online Advertising (12)

- Typography (12)

- gallery (12)

- Illustrator (11)

- Outsourcing (11)

- Social Media Optimization (11)

- web 3.0 (11)

- Game (10)

- Microsoft (10)

- Logos (9)

- Programming (9)

- Quote (9)

- Software (8)

- Yahoo (8)

- Download (7)

- EVENTS (6)

- HTML5 (6)

- Layouts (6)

- VC Funding (6)

- javascript (6)

- Crazy Boyz (5)

- Fonts (5)

- History (5)

- Ajax (4)

- Books (4)

- Content Management (4)

- Email Marketing (4)

- PPC (4)

- RSS (4)

- dark (4)

- twitter (4)

- wordpress (4)

- Affiliate (3)

- Blog (3)

- Facebook (3)

- Movies (3)

- SEO (3)

- flash (3)

- trends (3)

- Application (2)

- Apps (2)

- Diseases (2)

- Flat Design (2)

- Shopify (2)

- music (2)

- open source (2)

- ATT (1)

- Apple (1)

- Chrome (1)

- Dailer (1)

- Earn Money (1)

- IPL Broadcast (1)

- South Africa (1)

- Technology (1)

- Voice Video Text Chat (1)

- Wordpress themes (1)

- Youtring (1)

- android (1)

- business cards (1)

- colors (1)

- drupal (1)

- electronics (1)

- iPhone (1)

- podcast (1)

Blog offering website designing, website development, digital media marketing, social media strategies, facebook application development and services for online branding.

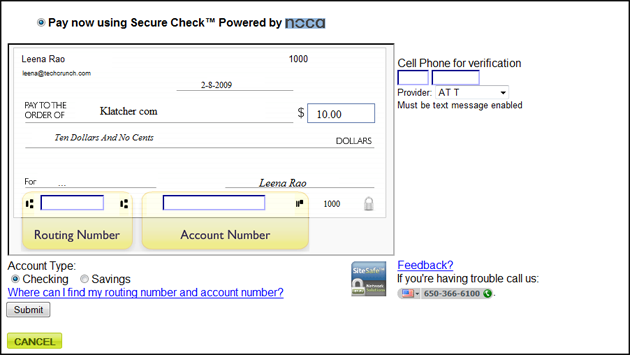

Is Noca The Next PayPal?

Noca, an online payments start-up we wrote about last year, is officially launching its payment service today. Formed by ex-Visa employees, Noca originally offered a micro-payments system via two Facebook applications, OneClickPay and HelpYourWorld. The company is now offering payment services for unlimited amounts. Currently, Noca has two clients; digital content provider Klatcher.com and a local little league site. The advantage of Noca’s system is that it allows online merchants to bypass high transactional fees (usually 2-3 percent plus $0.30) imposed by credit card companies on consumer purchases.

Whether using Google Checkout, PayPal or Amazon Flexible Payment Service, merchants have been unable to avoid these fees, which can be pricey on expensive or luxury items. Until now. Noca’s online payment service only charges 0.25 percent on transactions and eliminated the fixed $0.30 fee all together. Once Noca’s system is enabled, the consumer’s issuing bank underwrites the risk so that the merchant receives payment within 1 to 2 business days.

On the consumer side, Noca assures security and prevention of identity theft because the transaction avoids credit cards and uses debit transactions instead, where the money goes directly from the buyer’s checking/savings account to the merchant. The user enters account and routing numbers into a virtual check, in a process which the company insists is secure. After entering routing and checking numbers, Noca will then send a text message with a code to the user’s cell phone, which needs to be inputed for the transaction to be completed.

With credit tight, consumers might feel more comfortable paying for items directly from a checking account. And it assures security for both merchants and consumers. Can Noca give PayPal a run for its money?

Comments[ 0 ]

Post a Comment